A number of the world’s first actual 5G networks are coming on-line this yr, sparking loads of buzz and noise. Nevertheless, a variety of business specialists are cautioning that North American wi-fi community operators do not seem poised to put money into 5G networks like they did with 3G and 4G.

“Were unfavourable on the prospects for a 5G funding ‘cycle’ from wi-fi operators — at the very least over the near- and intermediate-term,” wrote the Wall Avenue analysts at Jefferies Analysis. “Primarily based on our evaluation, we imagine that the circumstances for a suitable return on funding (ROI) on 5G infrastructure are poor. Furthermore, the 5G funding ROI appears to be like drastically decrease than the ROI related to prior wi-fi funding cycles — particularly 3G and 4G.”

Why? All of it comes all the way down to flagging revenues in a saturated market. “The wi-fi service market is now a mature enterprise,” the analysts continued. “As such, operators motivations for main capital investments will probably be lowered. To be clear, we nonetheless imagine that 5G infrastructure deployment will occur. We count on that it’s going to merely be a cutover of current 4G investments to 5G expertise. Most significantly, we dont count on the general capex spending pie will develop because of 5G expertise availability. To be able to develop the general wi-fi market (and due to this fact capex budgets), the market requires new 5G-specific functions that may allow new income streams and ARPU progress — were simply not seeing them but.”

Supply: Jefferies

The Jefferies analysts argued that distributors like Ericsson and Nokia have been turning up the quantity on their 5G advertising — actions which have dovetailed with operators’ personal 5G advertising efforts — thus creating over-inflated expectations. “We expect that — to an excellent diploma — buyers have been caught in the midst of these advertising heavyweights,” the analysts wrote. “As such, we imagine Wall Avenue views are too constructive on the notion of a 5G funding ‘cycle’ — i.e. the place the scale of the general funding pie grows materially.”

Current feedback from AT&T’s CEO largely assist this view.

“We’re anticipating our capital spending price to come back down,” defined Randall Stephenson at a latest investor convention. He stated AT&T’s whole capex price range should hit $23 billion this yr, however might decline because the operator places the ending touches on its LTE buildout in Mexico, its transition to software-defined networking, its government-mandated fiber buildouts, and its so-called “one contact” wi-fi community upgrades.

Because of this, “I am really fairly optimistic that over the subsequent couple of years capital spending really works its means down,” Stephenson stated.

Others agreed that there are no clear drivers for a rise in operator 5G capex. “What are the functions which can be going to drive the investments?” requested Alex Gellman, the CEO of Vertical Bridge, the most important privately held tower firm within the US. “There’s actually nothing but you could grasp your hat on for a enterprise case.”

In feedback on the latest Join (X) commerce present, Gellman argued that operators do not but have a transparent approach to elevate revenues in 5G, provided that they already provide limitless knowledge plans. Nevertheless, he prompt that community slicing expertise, whereby operators might cost additional for some sort of premium product, might pave the way in which for operators to squeeze more cash from their clients.

“We’re so early,” added Jay Brown, CEO of Crown Citadel, one of many nation’s three essential tower corporations. “We’re not seeing, in any significant means, a deployment of 5G.”

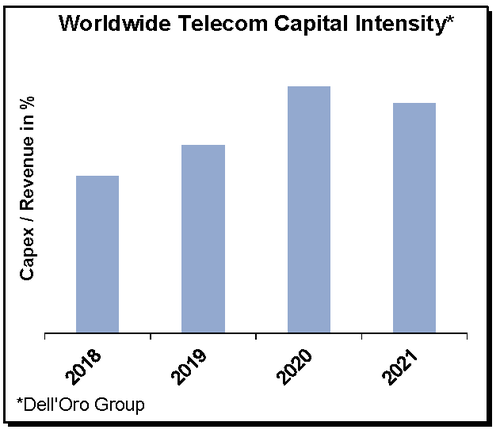

It is also vital to notice that some maintain contrasting views. For instance, analysis agency DellOro Group not too long ago forecast that international telecom capex progress will outpace operator income progress over the subsequent three years, reflecting operators’ elevated give attention to rolling out 5G.

Whereas the connection between capex/income will possible stay sturdy over time and constrained operator income progress will probably be one of many main inhibitors of additional telecom capex acceleration, we stay optimistic that there will probably be some deviation within the short-term to accommodate the rollout of 5G, DellOro’s Stefan Pongratz stated in a press release. And with the preliminary 5G capex steerage coming in stronger than anticipated, there’s a whole lot of pleasure proper now in regards to the potential 5G capex ramp.”

The Wall Avenue analysts at MoffettNathanson predicted that whole capital spending throughout the US telecom and cable panorama will rise three.three% year-over-year in 2019, to $71.5 billion. Nevertheless, the agency stated that capex spending will sluggish to 2.four% in 2020 (to $69.eight billion), after which to simply 2% in 2022 (to $66.eight billion).

“We imagine considerably increased spending — which would definitely be required for a significant millimeter-wave 5G construct — will await both a extra credible enterprise case (nonetheless some years away, in our view) or extra economically viable mid-band spectrum bands,” the analysts wrote.

The massive query, although, is whether or not 5G spending will change in the long run, throughout the subsequent 5 to 10 years — and what would possibly drive such a change.

“We’re simply on the beginnings of 5G,” stated Steve Vondran, president of US tower firm American Tower, including that he expects the migration to 5G to comply with the identical path that the business took to 4G.

The analysts at Jefferies acknowledged that operators might considerably elevate their 5G spending past 2022. “This evaluation is targeted on the near- and intermediate-term. Thats 2+ years in our view. Throughout that point, we imagine that the enterprise case that helps current 4G funding ranges will keep the identical,” they wrote. “Past our time horizon, its attainable that new functions will begin to enhance the wi-fi operator economics. Underneath that situation, we might envision the market measurement — in capex phrases — getting larger.”

For instance, 5G operators might finally run into the “iPhone impact.” Previous to the iPhone and different smartphones, operators did not see a lot demand for his or her 4G networks. However as high-powered, touchscreen smartphones grew to become more and more widespread, community visitors rose at such a precipitous tempo that operators needed to reply with main community investments with a view to maintain tempo with consumer calls for. The end result was a boon for tower corporations, community gear distributors and different wi-fi suppliers.

Already operators are hoping for the same “iPhone impact” on 5G. On the Join (X) present, T-Cellular CTO Neville Ray stated that he expects real-time augmented actuality (AR) to drive demand for 5G networks. He stated that, sooner or later sooner or later, glasses, telephones and different AR-capable gadgets will be capable of show real-time details about every kind of close by objects and folks — like batting averages displayed above a chosen hitter at a baseball recreation or social media updates previous the looks of an acquaintance at a espresso store.

“There are going to be a thousand issues like that on this area That is the subsequent period of the Web,” Ray predicted, including that it might take 5 to seven years. “Consider me guys, it’ll occur.”

Others concurred. “To ensure that the 5G catalyst to materialize, the carriers might want to see these new use instances and incremental income alternatives really accrue to them, and enhance their top-line trajectories,” wrote the Wall Avenue analysts at Deutsche Financial institution Analysis.

Mike Dano, Editorial Director, 5G & Cellular Methods, Mild Studying | @mikeddano

![]() (2) |

(2) |

![]()

![]()